When determining your annual salary, hourly wages such as $26.75/hr and $39.75/hr are common rates seen in many industries across the United States. These rates are particularly significant because they fall within the range of earnings for skilled professionals, technicians, and tradespeople. Understanding the exact annual equivalent of these hourly wages is important for individuals looking to calculate their earnings, plan their financial future, or negotiate salaries.

In this article, we will break down exactly how $26.75/hr and $39.75/hr translate into annual salaries and what factors can influence these figures. We will also discuss how these hourly rates align with different types of jobs, industries, and regions in the U.S., as well as provide insights into managing your income effectively. We aim to surpass existing online resources by providing detailed insights, practical advice, and real-world applications.

Contents

- 1 $26.75/hr – $39.75/hr: The Basic Calculation for Annual Salary

- 2 Factors That Influence Annual Salary

- 3 Jobs That Pay $26.75/hr – $39.75/hr

- 4 How to Budget and Plan Finances with $26.75/hr – $39.75/hr

- 5 FAQs about Earning $26.75/hr – $39.75/hr

- 6 Conclusion: Maximizing Your Earnings at $26.75/hr – $39.75/hr

$26.75/hr – $39.75/hr: The Basic Calculation for Annual Salary

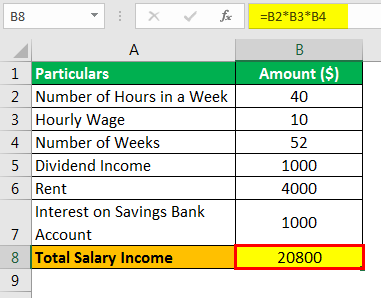

To determine how much $26.75/hr or $39.75/hr is annually, the following formula is used:

Formula:

Annual Salary = Hourly Wage × Hours per Week × Weeks per Year

For $26.75/hr:

If you earn $26.75 per hour, working 40 hours a week for 52 weeks a year (assuming full-time employment with no unpaid leave or significant holidays), the calculation would be:

- $26.75/hr × 40 hours/week × 52 weeks/year = $55,640 annually

For $39.75/hr:

If you earn $39.75 per hour under the same conditions, your annual earnings would be:

- $39.75/hr × 40 hours/week × 52 weeks/year = $82,680 annually

These figures represent your gross annual salary, which means the amount you would make before taxes and deductions. Keep in mind that depending on the specific state or city you live in, federal, state, and local taxes will affect your take-home pay.

Factors That Influence Annual Salary

While hourly rates like $26.75/hr and $39.75/hr provide a basic understanding of annual income, there are several variables that can influence your actual annual salary. These factors include:

1. Overtime and Extra Hours

Many employers offer opportunities to work more than 40 hours per week, especially in industries like healthcare, construction, and IT services. If you work overtime, which is typically paid at 1.5 times your regular hourly rate, this can significantly increase your annual income.

For example, if you earn $26.75 per hour and work 10 hours of overtime each week, that overtime is typically paid at $40.13 per hour ($26.75 × 1.5). This would add a substantial amount to your yearly salary.

2. Part-Time vs. Full-Time Employment

The above annual salary calculations assume full-time employment (40 hours per week). However, many workers in the U.S. work part-time. If you’re working fewer hours per week, your annual salary would be proportionately lower. For example, working 30 hours per week instead of 40 would result in a lower yearly income:

- $26.75/hr × 30 hours/week × 52 weeks/year = $41,730 annually

3. Paid Time Off (PTO)

Paid time off, such as vacation days, sick leave, or holidays, can also affect your earnings. If you work for a company that offers extensive PTO, your overall income may appear lower on paper since you’re not actively working those hours but still getting paid. Conversely, employers that don’t offer PTO might provide higher hourly rates to compensate.

4. Industry Standards

Different industries have varying standards for the number of hours worked, overtime opportunities, and bonus structures. For example, someone working in healthcare may have ample opportunities for overtime and on-call shifts, while those in corporate office settings might be limited to a strict 40-hour week.

5. Cost of Living Adjustments

Where you live also plays a significant role in how far your annual salary will go. A salary of $55,640 might be comfortable in smaller towns or less expensive regions but could be insufficient in cities with a high cost of living, such as New York, San Francisco, or Los Angeles.

Jobs That Pay $26.75/hr – $39.75/hr

The wage range of $26.75 to $39.75 per hour covers a wide variety of jobs across multiple industries. Here are some examples of professions that fall within this hourly pay range:

1. Registered Nurses (RNs)

- Average Pay: Around $35.00/hr

- Description: Registered nurses provide patient care, administer medications, and coordinate healthcare plans in hospitals, clinics, and other medical facilities.

2. Electricians

- Average Pay: Around $29.00/hr

- Description: Electricians install, maintain, and repair electrical systems in homes, businesses, and industrial facilities. This profession often has opportunities for overtime and bonuses.

3. Software Developers

- Average Pay: Around $38.00/hr

- Description: Software developers design and create computer programs and applications, with positions available in both corporate and tech startup environments.

4. Construction Project Managers

- Average Pay: Around $39.50/hr

- Description: These professionals oversee construction projects from planning to completion, ensuring that timelines and budgets are met.

5. Dental Hygienists

- Average Pay: Around $35.00/hr

- Description: Dental hygienists provide preventative oral care by cleaning teeth and examining patients for signs of oral diseases.

How to Budget and Plan Finances with $26.75/hr – $39.75/hr

Regardless of where you fall on the hourly pay scale between $26.75/hr and $39.75/hr, it is important to budget and plan your finances to ensure long-term financial health. Here are some steps to make the most of your income:

1. Track Your Income and Expenses

Create a detailed budget that tracks both your income and your expenses. Make sure to account for taxes, benefits, and deductions from your paycheck.

2. Save for Retirement

Even if you earn an above-average wage, it’s important to save for retirement. Contribute to a 401(k) or IRA if your employer offers these benefits, or set up a personal retirement savings plan.

3. Create an Emergency Fund

An emergency fund can cover unexpected expenses like medical bills, car repairs, or job loss. Financial advisors recommend having three to six months’ worth of living expenses saved up.

4. Plan for Taxes

Understand your tax bracket and set aside money each month for tax payments, particularly if you’re an independent contractor or freelancer. Consulting with a tax advisor can also help you maximize deductions and lower your taxable income.

5. Invest in Yourself

Consider investing in professional development or education to increase your skills and potentially raise your earning power. If you’re earning $26.75/hr, further education or certification could help you advance into a higher-paying role within your industry.

FAQs about Earning $26.75/hr – $39.75/hr

1. Is $26.75/hr or $39.75/hr a good wage?

Answer: Yes, these are solid hourly rates, particularly in the U.S., where the national minimum wage is much lower. These wages are well above average in many industries, offering a comfortable living, especially in regions with a lower cost of living.

2. How does overtime impact my annual salary at these hourly rates?

Answer: Overtime can significantly increase your annual salary. For example, if you work overtime at time-and-a-half, your hourly rate would increase to $40.13/hr for $26.75/hr and $59.63/hr for $39.75/hr. This can add a substantial amount to your total yearly earnings.

3. What are the best jobs paying between $26.75/hr – $39.75/hr?

Answer: Jobs like registered nurses, electricians, software developers, and dental hygienists fall within this pay range. These jobs require specialized skills or education, which often leads to higher pay.

4. How do taxes affect my salary at these rates?

Answer: Taxes will reduce your take-home pay. Federal, state, and sometimes local taxes will be deducted from your gross salary. The exact amount depends on factors like your filing status, tax bracket, and deductions.

5. Can I live comfortably on $26.75/hr – $39.75/hr?

Answer: In many areas of the U.S., these wages are sufficient to live comfortably, especially in regions with a lower cost of living. However, in cities with high costs of living, such as New York or San Francisco, budgeting is essential to maintain a comfortable lifestyle.

Conclusion: Maximizing Your Earnings at $26.75/hr – $39.75/hr

Earning between $26.75/hr and $39.75/hr offers a wide range of financial possibilities, especially when combined with overtime, benefits, and effective financial planning. While these rates are above average for many jobs in the U.S., understanding how to budget, invest, and plan your finances is essential for long-term success.

Whether you’re working in healthcare, construction, IT, or skilled trades, ensuring you make the most of your earnings by planning for taxes, retirement, and emergency funds will set you on the path to financial stability. By understanding and leveraging your hourly wage effectively, you can optimize your financial future and enjoy the rewards of your hard work.

+ There are no comments

Add yours