The real estate market is profoundly influenced by economic factors that shape supply, demand, and pricing trends. Whether it’s interest rates, employment levels, or economic growth, understanding these dynamics is crucial for buyers, sellers, investors, and industry professionals alike. This article explores how key economic factors impact the real estate market and what it means for stakeholders.

Contents

1. Interest Rates and Mortgage Availability

Interest rates set by central banks have a significant impact on the cost of borrowing for homebuyers and property investors. Lower interest rates typically stimulate demand by making mortgages more affordable, leading to increased home sales and higher property values. Conversely, higher interest rates can reduce affordability and dampen demand, potentially causing property prices to stabilize or decline.

Key Considerations:

- Monitor changes in mortgage rates to gauge affordability and market activity.

- Understand the relationship between interest rates and housing market cycles.

- Consider refinancing opportunities during periods of declining interest rates to lower mortgage costs.

2. Economic Growth and Employment Trends

Economic growth and employment levels directly influence consumer confidence and purchasing power in the real estate market. Strong economic growth, characterized by rising incomes and low unemployment rates, typically boosts housing demand and supports property price appreciation. Conversely, economic downturns or job losses can weaken demand, leading to slower sales and potential price declines.

Important Factors to Note:

- Pay attention to local and national economic indicators, such as GDP growth and unemployment rates.

- Assess job market trends in specific regions to understand housing demand dynamics.

- Consider the impact of economic policies and fiscal stimuli on real estate market conditions.

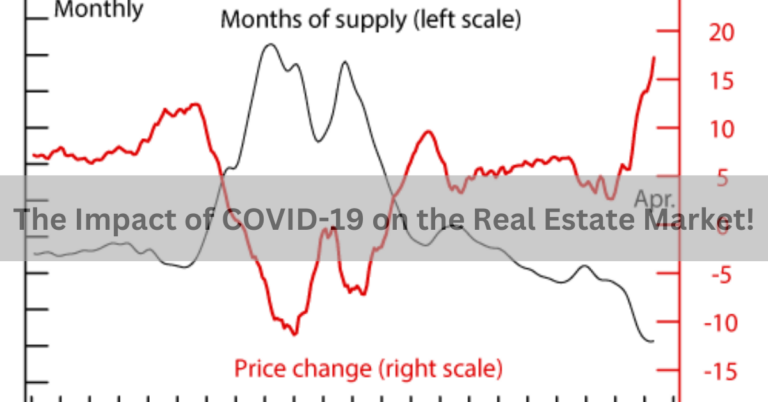

3. Supply and Demand Dynamics

The balance between housing supply and demand plays a critical role in determining property values and market conditions. Factors such as population growth, demographic trends, and housing construction activity influence the supply of homes available for sale or rent. Changes in demand, driven by economic factors like household formation and migration patterns, can lead to fluctuations in occupancy rates and rental prices.

Key Considerations for Supply and Demand:

- Evaluate local market conditions and inventory levels to gauge supply-demand dynamics.

- Monitor demographic shifts and housing preferences to anticipate future demand trends.

- Understand the impact of new construction and development projects on market equilibrium.

4. Government Policies and Regulations

Government policies, including tax incentives, zoning laws, and housing regulations, can significantly impact real estate market dynamics. Policy decisions related to property taxes, rent control, and land use restrictions can influence investment decisions and property values. Changes in regulatory frameworks or housing affordability initiatives may also affect market sentiment and investor behavior.

Important Policy Considerations:

- Stay informed about legislative changes affecting property taxation and investment incentives.

- Understand the implications of zoning ordinances and development restrictions on property values.

- Advocate for policies that support sustainable growth and affordability in the housing market.

5. Consumer Confidence and Market Sentiment

Consumer confidence reflects public perception of economic conditions and future prospects, influencing spending decisions and investment behavior. High levels of consumer confidence typically correlate with strong housing market activity and rising property prices. Conversely, uncertainty or pessimism about the economy can lead to cautious spending and subdued demand in the real estate sector.

Factors Affecting Consumer Sentiment:

- Monitor surveys and economic indicators measuring consumer confidence levels.

- Assess media coverage and public discourse about economic trends and market conditions.

- Consider the psychological impact of economic events and geopolitical developments on buyer behavior.

Conclusion

Economic factors are fundamental drivers of real estate market dynamics, shaping supply, demand, and pricing trends across local and global markets. By understanding how interest rates, economic growth, supply-demand dynamics, government policies, and consumer sentiment impact the real estate sector, stakeholders can make informed decisions and navigate market fluctuations effectively. Whether you’re buying, selling, investing, or advising clients in real estate transactions, staying informed about economic factors is essential for success in a dynamic and evolving market environment.

+ There are no comments

Add yours